My dear readers,

On the previous two newsletters we focused on chasing your receivables. This month you’ll be shifting your role from Accounts Receivables over to Accounts Payable. But, you need to take a good look in the mirror. Instead of collecting the money from your clients, you will now be doing the reverse: paying for your products and services.

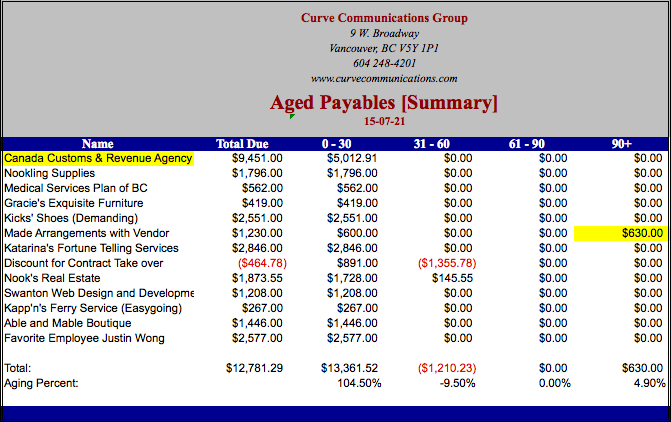

Take a look at the sample I created above. To get a closer look, you can download the full file by clicking the image above.

It still has columns for current, 30 days, 60 days and 90 days, but for the sake of your good credit rating, heaven forbid you owe anything for more than 30 days. You should always be in control of your cash flow and as a general rule, you pay everything off as soon as you can.

The only reason anything should go over 90 days is if you have a large amount owing and have made arrangement with your vendors to pay over time. Even then, try not to have it hanging over your Year End.

I look at my payables at least once a week to make sure there is nothing screaming at me for attention, and do a cheque run twice a month.

First, print out your list. Payroll should be a separate item, but you may have expense forms due to employees. Payroll is SACRED, so arrange to pay your expenses at the same time as payroll. If an employee incurs a company expense, I like to add the reimbursement to their payroll. What this means is that all your employees will get paid back for company expenses at the same time as their paycheque to save everyone some time.

After payroll, the top priority should be taxes payable. In Canada, employee remittances (EI, CPP, Income Tax) are due on the 15th of the following month. You also probably have to pay GST every quarter, PST and corporate taxes. The Canada Revenue Agency (CRA) expects monthly remittances for the current year. In the past, there was a day when you could pay your corporate tax in April of the following year, but now they want your moolah every month.

It goes without saying you should pay your taxes on time. The CRA is merciless, and will ding you not only interest, but penalty even if you are a couple of days late.

Next, look at all your invoices due. After a few months, you’ll quickly learn which vendors are demanding and which are lenient. Separate them by cheques, direct deposit, and Paypal to make your life easier. You may wish to put them on your company credit card to buy some more time and collect points. Paying by credit card comes with transaction fees, and your vendors may upcharge you the difference. If this is a significant amount of money, I’d recommend just being paying in another way.

If there are no terms on the invoice, assume they have given you 30 days to pay, which is the industry standard. Once in a while, review and contact your vendors and see if any of them is willing give you either longer terms (i.e. 45 days) or a discount if you pay early. Every bit counts.

After paying your bills, make sure there is enough money in your bank account or some cheques will bounce. Nothing sours a relationship quicker than your vendor’s bookkeeper getting notice of a bounced cheque, so always set apart some time to make sure there’s some wiggle room in your account for unexpected charges. I suggest arranging either an overdraft with your bank manager or a line of credit. This allows you to transfer in money before you mail the cheques. You can buy time with excuses like “the cheque is in the mail” or the “cheque is out for signing” but don’t expect them to work after the first time.

You will see there are some credits on the account, that is, if a vendor gives you a discount or if you paid early. Either way, post these credit invoices to keep the rest of the costs down . Don’t forget about these! Many companies unfortunately forget they even have them, so make sure you post them to your payables.

If you keep a close eye on your job costing, managing your payables shouldn’t the worst part of the month, but just another part of good business management.

Enjoy the rest of the summer and I will be back in August with more business management tips!